Simplify Your Car Loan Process: Embrace the Convenience of Online Loans

5 Reasons That Online Loans Make Borrowing Easier

You'll like just how online car loans make obtaining much easier for you. With simply a couple of clicks, you can access a large range of lenders and also lending options from the comfort of your own house. Say goodbye to waiting in lengthy lines up at the bank or submitting heaps of documentation. On-line loans supply a seamless as well as practical experience, saving you time and initiative.

Among the reasons that on the internet fundings are so popular is the speed at which you can get accepted. Standard fundings usually call for substantial paperwork and prolonged authorization processes, causing unnecessary delays. With on the internet fundings, you can obtain a decision within mins. This implies that if you have an immediate monetary demand, you can swiftly secure the funds you require.

Another benefit of on-line finances is the versatility they use. Whether you need a small personal funding or a larger organization lending, on the internet loan providers have a large range of options to suit your certain needs.

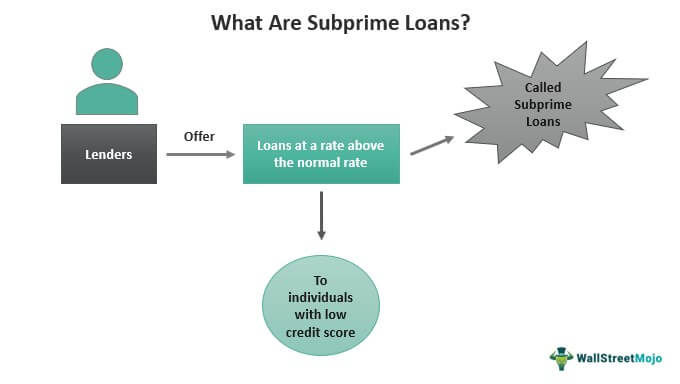

Online finances are accessible to a wider range of borrowers. Conventional lending institutions often have strict eligibility criteria, making it difficult for people with less-than-perfect credit report to safeguard a car loan. Online lenders, on the various other hand, are extra lenient and also think about various variables when analyzing your application. This indicates that even if you have a less-than-ideal credit history, you still have a possibility of getting accepted.

The Advantages of Making An Application For Loans Online

Requesting financings on the internet deals various advantages. The benefit factor can not be overstated. Gone are the days of needing to check out a physical bank branch and also wait in long lines. With online financings, you can apply from the convenience of your very own home, at any moment that matches you. The procedure is straightforward and also fast, with many applications taking just a couple of mins to complete. Additionally, the online platform permits you to compare various lending choices and rate of interest, making sure that you find the most effective deal for your demands. One more benefit is the rate at which car loans can be approved and paid out. Standard financial institutions typically take days or even weeks to process loan applications, however with online lendings, you can receive a decision within hours and also have the funds in your account the same day. Ultimately, on-line finances are usually a lot more obtainable to a wider variety of customers, including those with less-than-perfect credit report. Whether you need funds for a home remodelling, to consolidate debt, or to cover unforeseen expenses, using for a funding online is a wise as well as convenient choice.

Just How Online Lenders Simplify the Loan Authorization Refine

By utilizing the solutions of on-line loan providers, you can swiftly and also effortlessly browse through the funding authorization process. On the internet loan providers have transformed the method loans are authorized, making it much easier as well as extra convenient for borrowers like you.

The very first step is to find a reputable on-line loan provider. You can quickly contrast different lending institutions and also their terms by visiting their websites. You can start the application process as soon as you have selected a loan provider. On-line lenders typically call for basic details such as your name, get in touch with details, employment standing, and revenue.

After sending your application, you can expect a fast reaction from the lending institution. Unlike typical loan providers, on-line loan providers frequently give instant pre-approval choices. If your lending has been authorized, this suggests you won't have to wait for days or weeks to locate out.

The next action is to give any necessary documentation when you've been pre-approved. Online loan providers normally have a safe site where you can upload your documents. This removes the need for mailing or faxing documents.

Ultimately, when all your files have been evaluated, the loan provider will certainly make a last choice on your finance application. The funds will be deposited directly right into your financial institution account if authorized.

Recognizing the Comfort of Online Finance Applications

As soon as you've located a reputable on-line loan provider, navigating with the financing application procedure comes to be effortless and also quick. With standard lenders, you usually have to establish visits, submit stacks of documents, as well as wait on days and even weeks for a decision. But with on-line lenders, you can get a funding from the comfort discover here of your very see this page own home, at any moment that's practical for you. The online application types are usually easy and also simple, requesting basic individual as well as economic info. You can conveniently publish any kind of required files, such as financial institution statements or pay stubs, directly to the lender's internet site. The entire process can be completed in an issue of mins, as well as lots of on the internet loan providers give instantaneous choices on car loan applications. When your financing is approved, the funds are typically transferred into your bank account within one to two company days. On the internet lendings provide a level of benefit as well as speed that traditional lending institutions simply can not match. So if you need fast cash money, take into consideration requesting a car loan online and experience the simplicity on your own.

Streamlining Your Car Loan Settlement With Online Operating Systems

To make managing your finance payment much more efficient, you can use online systems that provide user-friendly user interfaces and practical payment options. These systems enable you to simplify your funding payment procedure and take control of your economic obligations easily.

With on the internet systems, you no longer have to go via the inconvenience of wells fargo home equity loan checking out a physical financial institution or composing as well as sending by mail checks. Rather, you can just visit to your account from the comfort of your own house and also pay with simply a couple of clicks. This not only saves you time yet also gets rid of the possibility of lost or delayed settlements.

Online platforms supply you with a clear overview of your car loan payment development. You can conveniently track your settlements, watch your continuing to be balance, and even established up automated settlements to guarantee you never ever miss out on a due day. This level of transparency and control empowers you to remain on top of your finance repayment journey.

Additionally, several on-line systems offer various payment choices, enabling you to select the technique that works finest for you. Whether you like utilizing a credit scores or debit card, establishing direct deposits, or linking your checking account, these systems can fit your choices.

Final thought

Embrace the simplicity of on the internet fundings and also streamline your car loan procedure. Whether you need a little personal finance or a bigger company financing, online lenders have a broad variety of alternatives to suit your specific needs. Conventional financial institutions often take days or even weeks to process car loan applications, however with on the internet fundings, you can receive a decision within hours and have the funds in your account the very same day. There you have it, welcoming the simplicity of on the internet financings can simplify your car loan process in more means than one. Start simplifying your funding process today and embrace the ease of online lendings.